ENTERTAINMENT UNIT

We will forge stronger connections with fans from both digital and physical perspectives, with IP as the axis.

As with the Group as a whole, the Mid-term Vision of the Entertainment Unit is “Connect with Fans.” We are aiming to forge stronger connections with fans from both digital and physical perspectives, with IP as the axis.

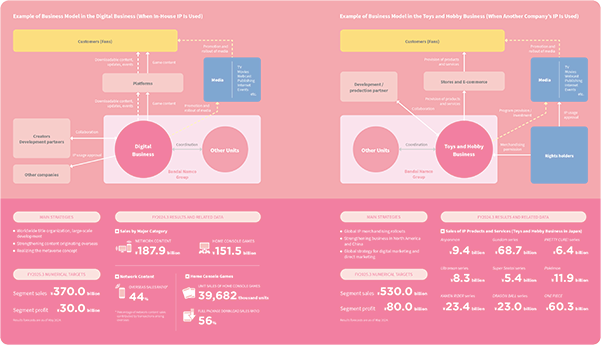

We are advancing “large-scale, long-term investment x short-cycle, rapid investment,” which is one of our main strategies. Going forward, we will pursue growth under an investment cycle that leverages the distinctive characteristics of the business models of the Digital Business and the Toys and Hobby Business. At the same time, we will strive to further deepen collaboration among businesses.

In addition, maximizing the value of IP itself will link directly to business growth and expansion. “Acquiring a focus on maximizing IP value” is also one of our main strategies. In accordance with this strategy, we will collaborate with external partners, especially for IP that is rolled out around the world on a Groupwide basis. This will lead to the maximization of IP value.

Digital Business:

We will deliver high-quality content that fans can enjoy over long periods of time by rebuilding and reinforcing our development structure.

In our Digital Business, we focus on two fundamental principles: “high-quality content that offers deep, long-lasting engagement” and “a diverse range of entertainment.” We are committed to delivering high-quality games and a variety of entertainment that exceed our fans’ expectations and resonate worldwide.

In FY2024.3, games geared toward global audiences, such as TEKKEN 8, achieved notable success. However, the overall performance of home console games was impacted due to differences in the product mix compared with the previous fiscal year, in which repeat sales of ELDEN RING contributed greatly. Profits also significantly declined due to such factors as the recording of valuation losses on new online game and disposal losses that accompanied the cancellation of certain titles in development, which resulted from a review of the composition of the titles. In light of these circumstances, we position FY2025.3, the final year of the current Mid-term Plan, as a year in which we will rebuild our structure so that we may achieve growth over the medium to long term. (Please see the Special Feature on page 50.)

Although we believe that the global game market will continue to grow moving forward, games are becoming increasingly larger in scale, which has led to longer development periods. We therefore need to bolster our development structure so that we can respond to these kinds of changes in the operating environment. To that end, we will prioritize the determination of our title portfolio and clarification of the kinds of content that we should create throughout the Digital Business as a whole. Upon doing so, we will focus efforts on enhancing our ability to steadily see titles through to completion, including those currently under development, and grow sales of our titles over longer periods of time. Although we will not reap the benefits of this newly enhanced development structure in the short term, we will pursue efforts to accelerate the completion of titles currently under development. Furthermore, we aim to boost our marketing and sales capabilities to ensure that fans can enjoy the titles we release over longer periods of time. To that end, we will oversee global marketing efforts through enhanced collaboration between Japan and North America. We will also examine the implementation of strategic initiatives and investments in a manner that caters to the needs of each region. In the Digital Business, maximizing the value of IPs themselves contributes directly to our business growth and expansion. By combining the strengths of each Group company from both digital and physical perspectives, we will work together with our fans to create a new world of entertainment, unprecedented in nature, that brings together fans from across the world, in a manner distinctive to Bandai Namco.

Toys and Hobby Business:

We will steadily execute the IP axis strategy in accordance with each region and target customer base as we aim to deliver an even greater number of products to fans.

The Toys and Hobby Business offers a wide range of product categories on an IP axis. Being successful in strengthening core IPs and rolling out products in a swift and timely manner, we realized a record-high business performance in FY2024.3. Under the core strategy of “global IP merchandising rollouts,” we will continue to accelerate product rollouts of core IP, including Gundam, supported by the tremendous potential of Japanese IPs, which are gaining popularity across the globe. By doing so, we will increase our fan base.

In the Toys and Hobby Business, we aim to reach an overseas sales ratio of 50% in the future and are currently strengthening our operations in North America and China with a view toward reaching this goal, alongside the promotion of Groupwide strategies. To date, we have expanded overseas rollouts by leveraging the strengths of each product category in a manner that caters to the characteristics of each region. Bandai Namco is unique in that it offers a broad range of product categories on an IP axis. By clearly showcasing the competitive edge this provides, we believe we can leverage unparalleled strengths.

Additionally, we are promoting a global strategy for digital marketing and direct marketing. In 2023, the number of members of PREMIUM BANDAI, the Group’s official e-commerce website, reached over 5.55 million in Japan, and the number of members overseas also continues to grow. Looking ahead, we will seek to deliver products to an even greater number of fans through targeted marketing activities that cater to the needs of each region.

Also, we will step up strategic investments to promote collaboration within the Entertainment Unit. Through the promotion of different investment cycles that draw on the advantages of each business—for example, large-scale, long-term investments in the Digital Business and swift, near-term investments in the Toys and Hobby Business—we will make unified efforts in the Entertainment Unit to maximize the value of IPs.

In addition, as part of our large-scale, growth-oriented investments under the next Mid-term Plan, we are currently constructing an additional plant at the Bandai Hobby Center with the aim of establishing a more stable production structure for model kits. (Please see the Special Feature on page 51.)

During the last year of the current Mid-term Plan, we will steadily execute the IP axis strategy in accordance with each region and target customer base as we aim to deliver an even greater number of products to fans.

MESSAGE

MESSAGE Integrated Report 2024

Integrated Report 2024 9.4 MB

9.4 MB DIVERSE RANGE OF BUSINESS AREAS

DIVERSE RANGE OF BUSINESS AREAS