CFO/CISO’S MESSAGE

Bandai Namco Holdings Inc.

thereby contributing to the further development

of the Bandai Namco Group

Leveraging our strengths by managing a diverse business portfolio

Leveraging our strengths by managing a diverse business portfolio

In FY2024.3, the Digital Business saw a significant decline in profits due in part to the recording of valuation losses on struggling titles and disposal losses following a review of the composition of the titles. Meanwhile, net sales on a Groupwide basis exceeded ¥1 trillion owing mainly to the contributions of the Toys and Hobby Business and the Amusement Business, among others, which both achieved record-high performances. In the Digital Business, given the changes occurring in the market environment, we are continuing to advance efforts to strengthen our evaluation system at the title development stage, which we started in the previous fiscal year.

Specifically, we have introduced various measures, including the establishment of a new committee for evaluating titles right away from the initial development stage based on a business perspective. As development periods become more prolonged, however, we do not expect to see tangible benefits from the strengthening of the development review system until the period of the next Mid-term Plan and beyond.

Executing strategic investments that underpin our pursuits

Executing strategic investments that underpin our pursuits

Separate from the ordinary investment activities of the operating companies, Groupwide strategic investments have been set at ¥40.0 billion under the current Mid-term Plan. This amount is composed of (1) ¥25.0 billion to maximize IP value and (2) ¥15.0 billion for IP metaverse-related initiatives. Both types of investments are being implemented according to plan. With regard to (1), we are pursuing investments to create new IPs and form synergies between IP projects across the Group and are also making investments through start-up investment funds. (2) Considering our efforts to develop the Data Universe, which will be the foundation of the metaverse, are nearing completion, we will soon be entering into the utilization phase.

Striking a balance between strengthening our financial foundation and enhancing capital efficiency

Striking a balance between strengthening our financial foundation and enhancing capital efficiency

In a highly volatile industry, we have sought to build a stable financial foundation that is less susceptible to whether we have released hit products and other such factors. Since the plan prior to the previous Mid-term Plan, operating profit has increased by an average of ¥20.0 billion during the three-year period of each plan, demonstrating the effectiveness of our initiatives. Moving forward, we will strive to further enhance our robust financial foundation.

Regarding profitability, the current Mid-term Plan aims for a stable operating profit margin of over 10% and an ROE of over 12%, with target values being achieved in all years of the plan. Our industry is undergoing rapid change, thus we recognize the need to maintain a certain level of financial capacity. We aim to have at all times a certain amount of funds for various objectives. These include a year’s worth of personnel expenses in order to maintain employment of human resources; a necessary level of working capital to secure stable operational administration, including business partners; and Investment in game content development etc. At the moment, we are constructing production facilities for the Toys and Hobby Business and venues for live events with a view toward future growth. We aim to ensure that we can swiftly execute investments in these kinds of growth-oriented projects at all times.

For our balance sheet management strategy, we will ensure an adequate level of shareholders’ equity while also striving to enhance capital efficiency. We annually examine the appropriateness of maintaining cross-shareholdings at Board of Directors’ meetings based on various indicators focused not only on effectiveness in the execution of business strategies but also on capital costs. While we are working to steadily reduce the number of cross-shareholdings, we will maintain them at the level needed to promote our IP axis strategy. We sold a portion of shares of common stock of Toei Animation Co., Ltd., by taking part in the company’s secondary offering.

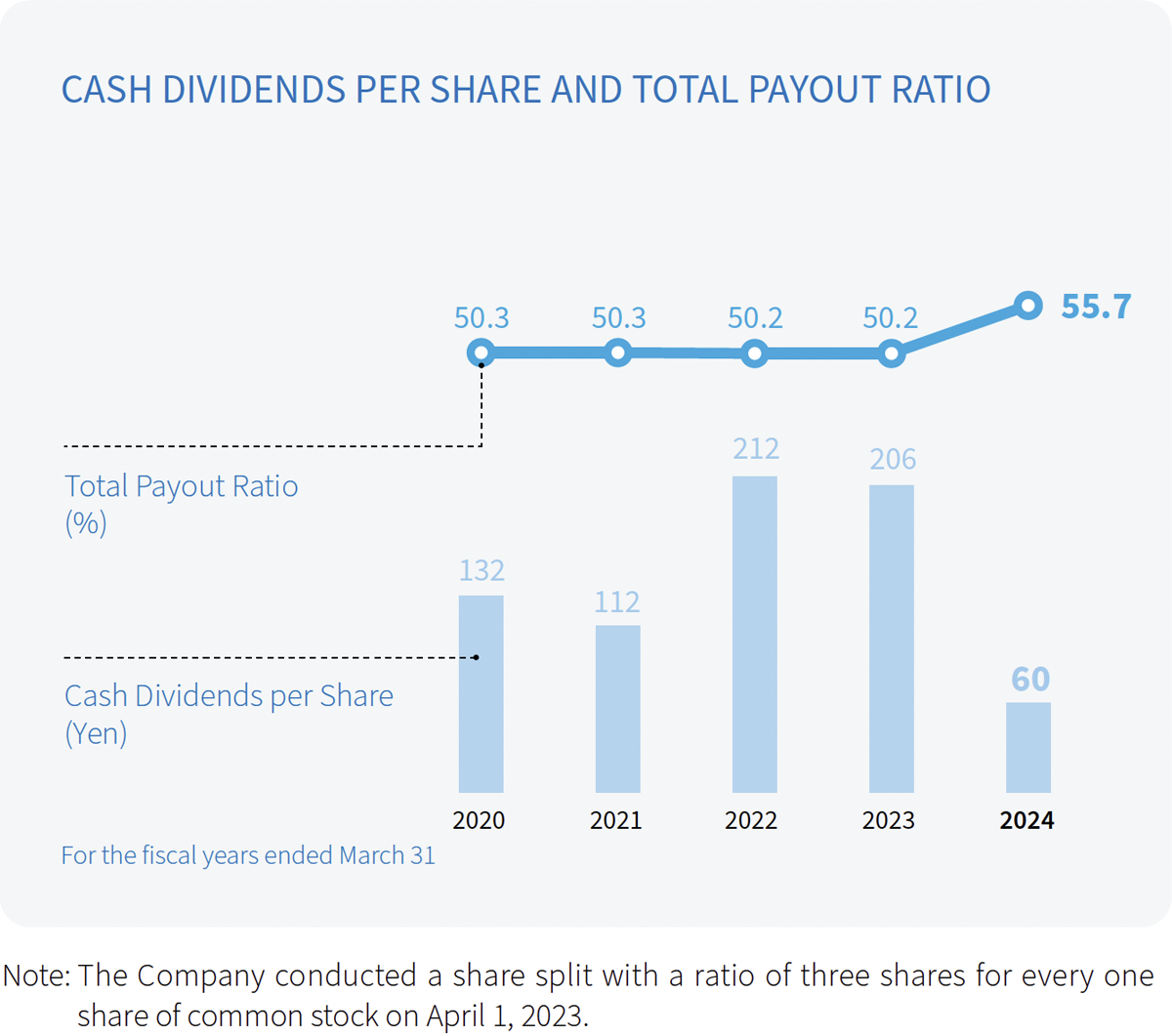

With regard to shareholder returns, our basic policy calls for a focus on the maintenance of stable dividends over the long term and on the cost of capital, targeting a total return ratio of 50% or more based on stable dividend payments of 2% of DOE (dividends on equity). Based on this policy, we set the annual dividend for FY2024.3 at ¥60 per share (base dividend of ¥20; performance-based dividend of ¥40), for a DOE of 5.8%. In addition, our total return ratio came to 55.7% as a result of our acquisition of treasury share totaling ¥17.2 billion. With comprehensive consideration for our share price and cash on hand, etc., we will continue to carry out an appropriate level of shareholder returns.

Promoting security measures from the perspectives of systems and personnel

Promoting security measures from the perspectives of systems and personnel

For information security, we are advancing Groupwide initiatives under a two-pronged approach of (1) system-based security measures and (2) measures to prevent human error, based on the lessons learned from the unauthorized access incident that occurred in 2022. With regard to (1), we are working to standardize security levels at each Group company. At the same time, we are auditing and organizing the information we possess so that we can immediately assess the severity of damages when an incident occurs. Concerning (2), we are organizing our initial response procedures to make them easy to understand and engaging in awareness-raising activities. In addition, we are creating opportunities for the CISOs of each Group company to exchange information in order to ensure a consistent level of awareness.

Crossing the bridge toward the next Mid-term Plan

Crossing the bridge toward the next Mid-term Plan

For FY2025.3, we forecast increases in sales and profits, projecting net sales of ¥1.08 trillion and operating profit of ¥115.0 billion (based on figures announced in May 2024). Although these forecasts are slightly lower than what we anticipated at the time of the current Mid-term Plan’s formulation, we remain committed to achieving the targets of the plan until its conclusion. Furthermore, FY2025.3 represents the year in which we will cross the bridge toward the next Mid-term Plan. Specifically, we will solidify the foundation for the future growth of the Group by drafting effective financial initiatives and establishing the necessary systems for implementing them. We are committed to meeting the expectations of all our shareholders.

MESSAGE

MESSAGE Integrated Report 2024

Integrated Report 2024 9.4 MB

9.4 MB DIVERSE RANGE OF BUSINESS AREAS

DIVERSE RANGE OF BUSINESS AREAS