MESSAGE

CFO (Chief Financial Officer)

Division General Manager of Corporate Planning Division

Bandai Namco Holdings Inc.

our financial strategies and promote

market-oriented management with a view

to gaining fans in the capital markets

Expanding Our Earnings Base in a Stable Manner

Expanding Our Earnings Base in a Stable Manner

In FY2025.3, we achieved record-high net sales and operating profit, thereby concluding our previous Mid-term Plan on an extremely high note. The average operating profit over the three-year period of the plan increased significantly compared with that of the plan before, which helped further strengthen our earnings base. Under the current Mid-term Plan, we aim to reinforce our earnings base to an even greater extent by increasing our three-year average operating profit by 20% or more.

The Toys and Hobby Business, which has continued to achieve a record-high performance, saw a strong performance across nearly all categories. As such, this business is expected to drive the growth of the Group moving forward. Moreover, in the Digital Business, we continued to focus on the optimization of our title portfolio with the aim of building on the earnings from stable mainstay app titles through additional gains from the success of new titles. In the Visual and Music Business, the global broadcast and licensing of multiple titles contributed to our overall performance, backed by strong fan support. Performance in the Amusement Business also remained solid, driven by robust sales at existing facilities in Japan and of amusement machines.

Striving for Global Growth with a Focus on Market Needs

Striving for Global Growth with a Focus on Market Needs

For the current Mid-term Plan, we have added overseas sales ratio on a destination basis as a new numerical target and have changed from a target for return on equity (ROE) to one for equity spread (ROE less shareholders’ equity cost).

Under the previous Mid-term Plan, our overseas sales ratio on a destination basis rose to 40%. Reaching our target for an overseas sales ratio of 50% or more by the final year of the plan through only the strong performance of our domestic business is a great hurdle to clear, so we will therefore continue to strengthen global rollouts.

At the moment, we recognize that our shareholders’ equity cost is around 8%. Looking ahead, we will continue to request calculations of this figure from external expert organizations and, after verification, disclose the results accordingly. At the same time, we will aim to continue to achieve ROE that exceeds this cost by 5% or more. While steadily executing growth investments, we will promote market-oriented management by enhancing our investor relations activities and increasing the accuracy of our results forecasts.

Accelerating Our Financial Strategy

Accelerating Our Financial Strategy

Under the Current Mid-term Plan

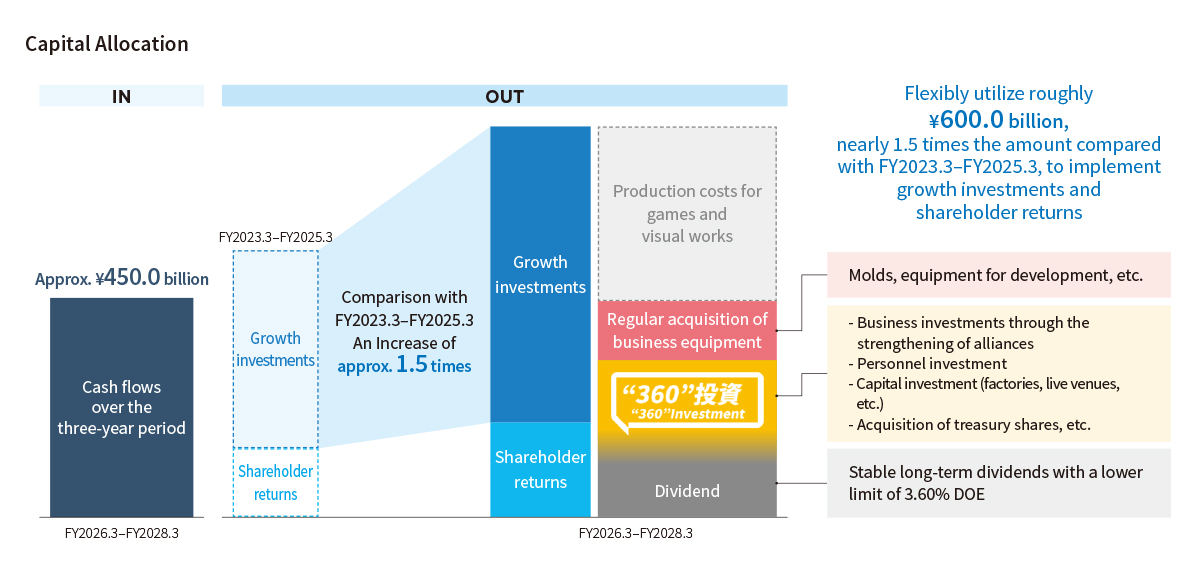

We have revised certain parts of our policy toward cash on hand. Based on this revision, we now aim to maintain ¥350.0 billion in cash on hand at all times. This amount includes one year’s worth of personnel expenses to ensure that employees can take on challenges in a free and open manner; around two months’ worth of average monthly sales to ensure sufficient working capital to engage in smooth development activities with partner companies and production activities; and one year’s worth of capital for 360 investments, which I will talk about later.

During the three-year period of the current Mid-term Plan, we will prioritize the allocation of capital to execute growth investments totaling roughly ¥600.0 billion, which is 1.5 times the amount under the previous Mid-term Plan. We aim to strengthen our IP axis strategy and stabilize the earnings base of our businesses through these growth investments. Additionally, we will proactively allocate funds to cover production costs for games and visual works and to implement conventional capital investments. Separately from these growth investments, we plan to allocate around ¥150.0 billion in 360° investments focused on the medium- to long- term future.

360° investments are strategic investments made with the aim of creating connections with all of our stakeholders, both inside and outside Japan, and cultivating new business domains. These investments include joint investments with partner companies and will help us pursue business alliances with promising companies. Once a business is on track for growth, it will be handed over to the business companies, thereby allowing us to focus on growth investments on a Groupwide basis.

Further Enhancing Shareholder Returns

Further Enhancing Shareholder Returns

We have been steadily working to reduce and liquidate cross-shareholdings for over a decade. Each fiscal year, the Board of Directors examines all shares held by the Group to determine their appropriateness. At the same time, we continue to hold shares in key partner companies that are important in the promotion of the IP axis strategy.

Our basic policy on shareholder returns is to maintain a total return ratio of 50% or more. We also aim to provide a long-term, stable dividend with a minimum dividend on equity (DOE) of 3.60%. Furthermore, we examine the acquisition of treasury shares as necessary, taking into comprehensive consideration such factors as our performance, the progress status of investment plans, available liquidity, and trends in share price. In tandem with the start of the current Mid-term Plan, we have made partial revisions to our basic shareholder return policy.

With these revisions, we set the annual dividend for FY2025.3 at ¥71 per share (base dividend of ¥22; performance-based dividend of ¥49) for a DOE of 6.2%. In addition, our total return ratio came to 62.7% following our acquisition of treasury share totaling ¥34.9 billion. Guided by our new basic policy, we will continue to carry out an appropriate level of shareholder returns.

Fulfilling My Role as CFO of the Bandai Namco Group

Fulfilling My Role as CFO of the Bandai Namco Group

In these ways, the current Mid-term Plan strikes a good balance between sales and profit targets and elements such as capital policies, growth investments, and shareholder returns. As the CFO and someone who took part in the formulation of the plan, my foremost responsibility is to ensure its steady execution.

In particular, we are pursuing a scale of growth investments under the plan that is greater than ever before. To facilitate the effective distribution of funds between our approximately 110 Group companies, we must employ a cash-pooling system under which funds are consolidated at regional offices. While we have made some progress in implementing the system, there are still regions and business areas that remain uncovered, so we will continue working to build the infrastructure necessary.

As made clear by our Purpose and Mid- to Long-term Vision, the operations of the Bandai Namco Group are made possible thanks to our fans. Under the current Mid-term Plan, we have expanded the definition of “fans” to encompass all of our stakeholders. Moving forward, we will maintain ongoing dialogues with capital markets as we pursue highly transparent management so that we can earn the support of an even greater number of investors.

What Purpose Means to Me

Our Purpose embodies who we are as a group. We gathered input from key stakeholders in Japan and overseas to help us compile a vision for the Group’s future, and our Purpose represents this vision woven into a single, unifying statement. Each of our businesses operates with the speed and focused management of a small to medium-sized enterprise, which has been a key strength of the Group. Our Purpose is what unites all of our businesses. Of course, our Purpose involves forging connections with fans, creating new entertainment, and making people smile, but I also believe it encompasses the generation of both economic and social value.

CHAIRMAN’S MESSAGE/PRESIDENT’S MESSAGE

CHAIRMAN’S MESSAGE/PRESIDENT’S MESSAGE Integrated Report 2025

Integrated Report 2025 16.8 MB

16.8 MB MAJOR IPS IN GROUP PRODUCTS AND SERVICES

MAJOR IPS IN GROUP PRODUCTS AND SERVICES