Addressing Climate Change

The Bandai Namco Group believes that measures to address climate change are essential for the realization of a sustainable society and for the sustainable growth of its businesses. Accordingly, we established the Bandai Namco Group Sustainability Policy in April 2021. We also agree with the aim of the Paris Agreement to “keep a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5 degrees Celsius.” In order to further accelerate our efforts to reduce greenhouse gas emissions, we have established medium- to long-term targets for the transition to a decarbonized society. In addition, in 2021, we began disclosing information in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In September 2023, we officially announced our support for these recommendations. We also participate in the TCFD Consortium and strive to collect the latest information on climate change.

In fiscal 2024, we upgraded our scenario analysis to provide a more detailed understanding of the impacts of climate change on the Group. Specifically, in addition to future forecasts from external institutions, we used activity data from each business unit to assess the future impact on the Group for each of these units. Based on the results of this analysis, we will pinpoint the risks and opportunities that the Group should prioritize and strengthen our response going forward.

Based on the recommendations of the TCFD, we explain the systems and policies for initiatives from the perspectives of governance, strategy, management, and indicators and targets, for the risks and opportunities that climate change poses to our business.

Governance

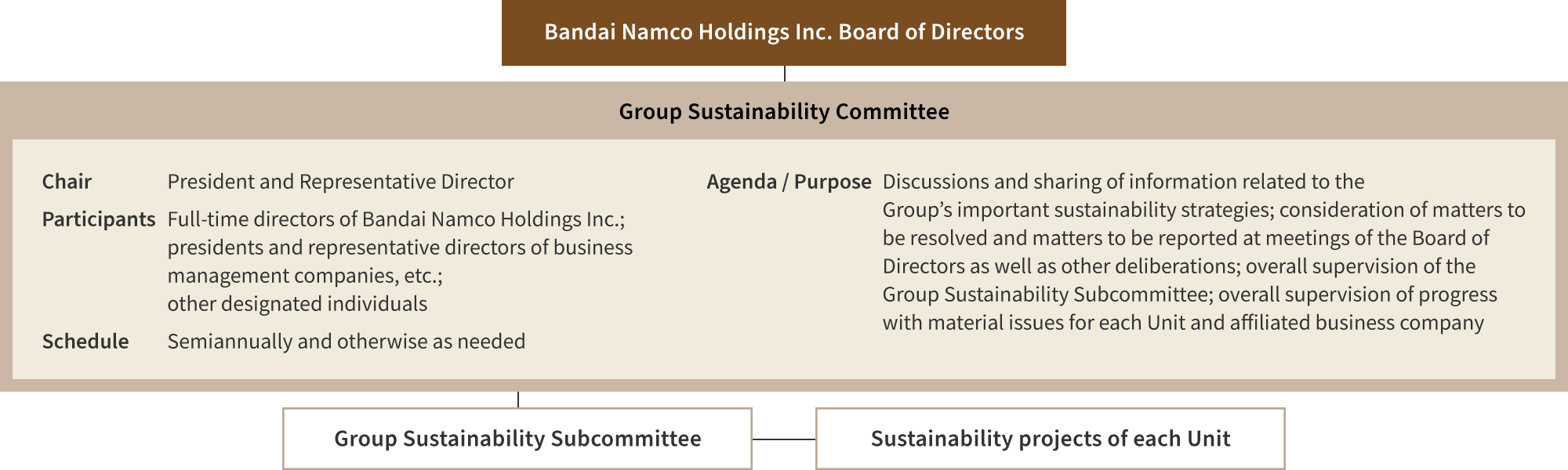

Recognizing the importance of societal sustainability for its business activities, the Group has established the Group Sustainability Committee, chaired by the president and representative director, to determine and implement sustainability-related activities more quickly.

The committee meets semi-annually (twice a year) to discuss our response to climate change as one of its key agenda items and to consider various measures. Based on the results of these meetings, each Group company implements measures. The details of these discussions and the status of activities are regularly reported to the Company’s Board of Directors, which deliberates on and oversees them. Approximately half of the directors on the Board of Directors, including the president and representative director who serves as chair, have experience or expertise in sustainability (for details, see “Corporate Governance”).

Additionally, the Group Sustainability Subcommittee has been established as a subordinate organization under the committee, headed by a director of Bandai Namco Holdings. The subcommittee promotes activities in line with the Group’s Sustainability Policy and materiality. The Sustainability Policy, based on the key strategies of the Group’s Mid-term Plan, aims to advance activities for realizing a sustainable society together with fans. Under this policy, each Group company takes actions centered on the material issues set out for sustainable activities. Furthermore, sustainability projects for each business unit are implemented after information sharing and policy considerations within each unit, based on information sharing and discussions by the Group Sustainability Committee and Group Sustainability Subcommittee.

Sustainability Promotion System Diagram

Strategy

We conducted scenario analysis to understand the impacts of risks and opportunities arising from climate change.

Method of Scenario Analysis

To clarify the impacts of climate change on the Group’s business, we conducted a scenario analysis for 2030 using the following two scenarios. This time, we adopted the 1.5°C scenario, in which temperature increases are held in check by aggressive decarbonization policies, and the 4°C scenario, in which temperature increases progress due to limited decarbonization policies. As we performed analysis using each scenario, we referred to Representative Concentration Pathways (RCP) scenarios reported by the Intergovernmental Panel on Climate Change (IPCC) and scenarios reported by the International Energy Agency (IEA). RCP scenarios were used to analyze the physical impacts of climate change, such as disasters, while IEA scenarios were used to analyze the impacts of the transition to a decarbonized economy, such as the introduction of carbon taxes.

| A world where proactive climate action is implemented to limit temperature increases | A world where decarbonization policies are limited and temperature increases and climate change progresses | ||

|---|---|---|---|

| 1.5°C scenario | 4°C scenario | ||

| Overview | A scenario in which the temperature increase is limited to 1.5°C from the late 19th century to 2100. The impacts (transition risks) of the transition to a decarbonized society, such as the introduction of a carbon pricing system, become obvious. The impacts of physical risks are relatively small compared to the 4°C scenario. | A scenario in which the temperature increases by nearly 4°C from the late 19th century to 2100. The physical impacts (physical risks) of climate change, such as disasters, become obvious. Since regulations on climate change are not tightened, the impacts of the transition risks are small. | |

| Referenced scenarios | Transition risks | IEA Net Zero Emission by 2050 (NZE), IEA Announced Pledges Scenario (APS), IEA Sustainable Development Scenario (SDS) | IEA Stated Polices Scenario (STEPS) |

| Physical risks | IPCC RCP 1.9 IPCC RCP 2.6 |

IPCC RCP 8.5 | |

Note: In cases where there was no information on the 1.5°C scenario, reference scenarios classified as the 2°C scenario were used.

Results of Scenario Analysis on All of Our Business Units

1.5°C scenario

In the 1.5°C scenario, various impacts are expected from the transition to a decarbonized society, including the introduction of carbon taxes and increased demand for low-carbon energy and products. The risks with the greatest potential impact on the Group are rising raw materials procurement costs due to restrictions on the use of fossil fuel-derived plastics and surging demand for metal resources as decarbonization technologies become more widespread. In addition, a common risk across all business units is higher operating costs resulting from carbon taxes on greenhouse gas (GHG) emissions from energy use, such as electricity.

On the opportunity side, promoting initiatives to reduce environmental impacts may lead to improved evaluations from stakeholders, including investors, as all of the Group's businesses involve providing services to end consumers. This also offers an opportunity for enhancing corporate value.

In order to address these issues, in response to plastics regulations and soaring raw materials prices, we are not only using recycled materials, but also introducing substitute materials and developing resource-saving products (capsule-less Gashapon, Eco-Amusement products, and Eco Medal certified products) and taking other initiatives to reduce the amount of plastics used through innovative product designs. Additionally, in response to carbon taxes, we are working to introduce renewable energy sources such as solar power, reduce electricity consumption at amusement facilities and live event venues, and promote eco-driving activities and the use of low-emission vehicles in logistics departments. These efforts will not only help reduce risks but also contribute to increasing corporate value through appropriate disclosure of information regarding climate change.

Details of each measure can be found on the “Initiative Search” page.

4°C scenario

The 4°C scenario predicts acute physical impacts, such as intensifying extreme weather due to climate change, as well as greater chronic impacts due to rising average temperatures. Risks facing the Group in this scenario include the suspension of business activities due to damage such as flooding at our business sites and supply chain bases. In addition, sales of outdoor events and services are expected to decrease due to changes in weather patterns, such as more days of extreme heat and heavy rain.

As opportunities, it was assumed that changing weather patterns would increase sales of home video games and toys and sales of indoor events/services due to more time spent at home and indoors.

As an initiative to mitigate risk, we have formulated the Basic Policy on Business Continuity Planning and are conducting drills in preparation for contingencies. In addition, by holding virtual events, we are developing services that are unaffected by extreme heat or rainy weather. These initiatives are also expected to contribute to the acquisition of opportunities, and in the future, we will develop a variety of services so that customers can use entertainment content regardless of the weather.

| Items | Anticipated scenario | Time horizon | Importance | Relevance with risks/opportunities for each business unit ●:Relevance ○:Partial relevance -:No relevance |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Risks and opportunities | Category | Subcategory | Digital | Toy and Hobby | IP Production | Amusement | Affiliated business companies | |||

| Transition risks | Government/regulations | Introduction of carbon pricing |

|

Medium to long term | Medium | ○ | ○ | ○ | ● | ● |

| Regulations on the use of fossil fuels |

|

Medium to long term | Low | ー | ○ | ー | ー | ○ | ||

| Regulations on plastics and resource recycling |

|

Medium to long term | High | ○ | ● | ○ | ○ | ー | ||

| Renewable energy and energy conservation policies |

|

Short to long term | Medium | ○ | ○ | ○ | ● | ○ | ||

| Obligation of information disclosure |

|

Medium to long term | Low | ー | ○ | ー | ー | ー | ||

| Markets | Fluctuations in raw material costs |

|

Medium to long term | High | ○ | ● | ○ | ○ | ○ | |

| Changes in customer behavior |

|

Short to long term | Low | ー | ー | ー | ○ | ー | ||

| Reputation | Changes in reputation among investors |

|

Medium to long term | High | ● | ● | ● | ● | ● | |

| Opportunities | Markets | Changes in customer behavior |

|

Short to long term | Low | ○ | ○ | ○ | ○ | ー |

| Reputation | Changes in investor evaluation |

|

Medium to long term | High | ● | ● | ● | ● | ● | |

| Items | Anticipated scenario | Time horizon | Importance | Relevance with risks/opportunities for each business unit ●:Relevance ○:Partial relevance -:No relevance |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Risks and opportunities | Category | Subcategory | Digital | Toy and Hobby | IP Production | Amusement | Affiliated business companies | |||

| Physical risks | Acute | Intensification of abnormal weather (typhoons, heavy rains, landslides, storm surges, etc.) | We anticipate the following issues to occur due to an increase in wind and flood damage resulting from the intensification of abnormal weather:

|

Short to long term | Medium | ○ | ○ | ○ | ● | ○ |

| Droughts |

|

Short to long term | Low | ○ | ○ | ○ | ○ | ー | ||

| Chronic | Rise in the average temperature | We anticipate the following issues to occur due to summer heatwaves caused by a rise in the average temperature:

|

Short to long term | Medium | ○ | ○ | ○ | ○ | ○ | |

| Changes in rainfall and weather patterns |

|

Short to long term | Low | ー | ー | ○ | ○ | ー | ||

| Impact on raw material cultivation due to a rise in the average temperature |

|

Medium to long term | Medium | ー | ○ | ー | ー | ー | ||

| Rising sea levels |

|

Medium to long term | Low | ○ | ○ | ○ | ○ | ○ | ||

| Increase in infectious diseases |

We anticipate the following issues to occur if an infectious disease prevalent in tropical regions spreads north and becomes prevalent in Japan or other countries:

|

Medium to long term | Medium | ー | ー | ○ | ● | ー | ||

| Opportunities | Chronic | Rise in the average temperature |

|

Short to long term | Medium | ● | ○ | ● | ○ | ー |

| Changes in rainfall and weather patterns |

|

Short to long term | Medium | ○ | ー | ○ | ー | ー | ||

| Increase in infectious diseases |

|

Medium to long term | High | ● | ー | ● | ー | ー | ||

Time horizon

Short-term: 0–1 year; medium-term: up to 5 years (around 2030); long-term: medium term and beyond

Importance

High: impact of ¥5 billion or more; medium: impact of ¥100 million to less than ¥5 billion; low: impact of less than ¥100 million

Relevance

●: 1% or more of operating profit by business; ○: less than 1%; ー: no relevance

Risk Management

The Group Sustainability Committee discusses risks and opportunities related to sustainability, identifies material issues that the Group should address, and promotes sustainability activities throughout the Group.

When identifying and assessing climate change-related issues in our business, we conduct scenario analysis and assessments of future financial impacts. In this assessment process, we calculate the impact for the entire Group and for each business unit for each risk and opportunity based on future forecasts provided by external organizations such as the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), as well as our own data on business activities. Based on the calculation results, we compare the impact of each risk and opportunity with the operating profit of each business unit to assess the degree of relevance for each business unit. Additionally, we determine the importance from a company-wide perspective, taking into account the impact on the entire Group.

To promote sustainable activities, the Group Risk Management Committee, which oversees the Group’s crisis management, the Group Compliance Committee, and each Group company work closely together (for details, see “Risk Management”).

Each Group company implements measures tailored to the characteristics of its business in line with our material issues. In turn, the results for each fiscal year—both for the Group as a whole and for each business segment—are analyzed, leading to improvements in measures for the following fiscal year and beyond. The Group Sustainability Committee discusses the results of this analysis and then reports them to the Board of Directors, which deliberates and oversees the results as necessary.

Indicators and Targets

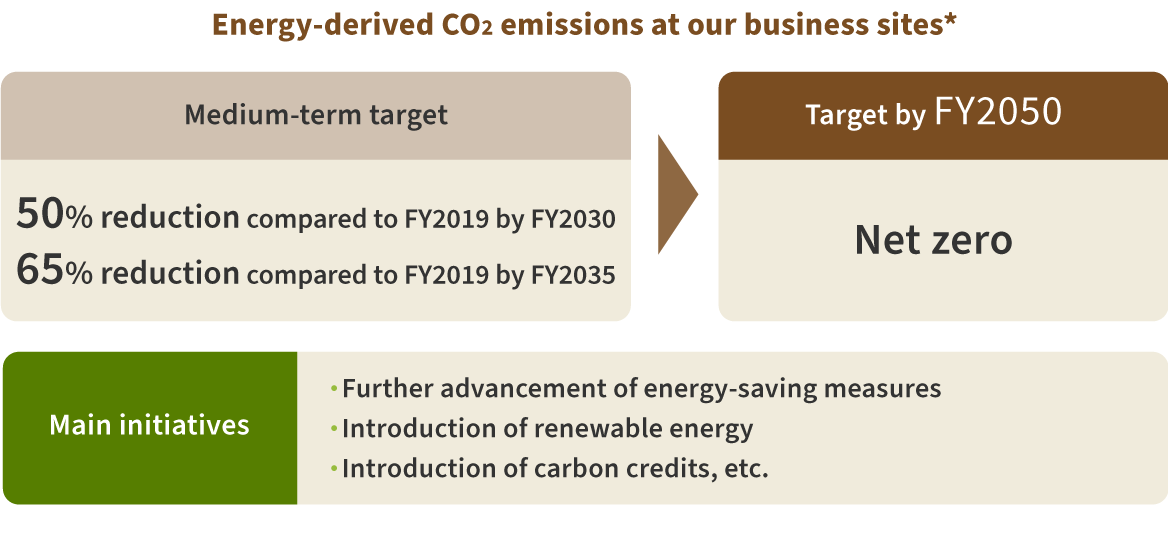

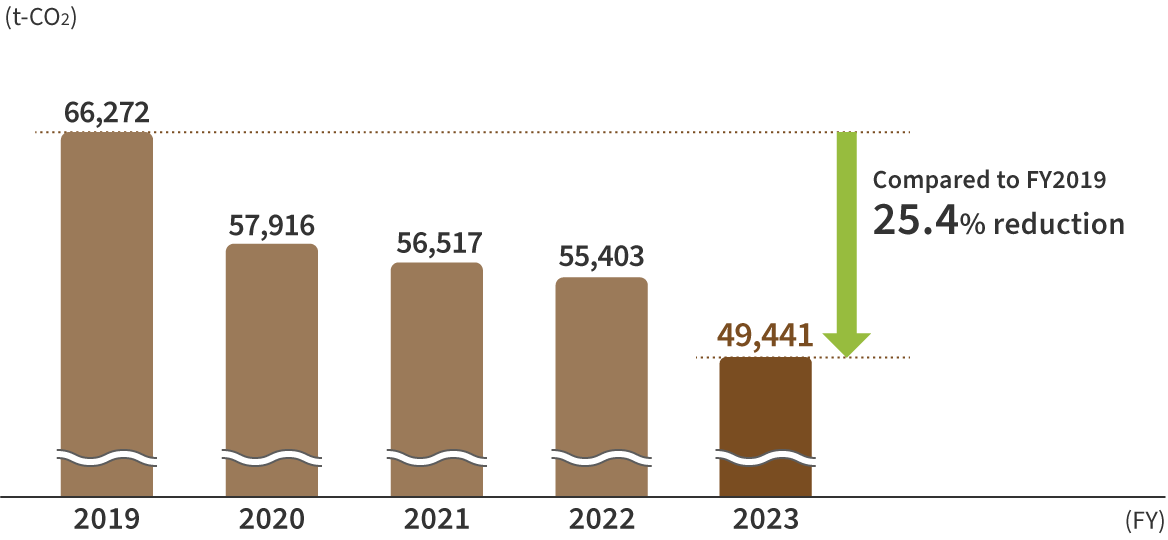

To evaluate and manage the progress of its ESG management and the impacts of policy risks on climate change, the Group has set greenhouse gas emissions as an indicator and has established a medium-term target of reducing energy-derived CO2 emissions at its sites by 50% compared to fiscal 2019 by 2030 and by 65% compared to fiscal 2019 by 2035.

Furthermore, our target for 2050 is to reduce the amount of energy-derived CO2 emissions at Group business sites (offices, own plants, directly operated amusement facilities, etc.) to net zero. We will further promote energy-saving measures and introduce renewable energy to achieve these targets.

Medium- to Long-term Targets for Decarbonization

*Offices, own plants, directly operated amusement facilities, etc.

Bandai Namco Group CO2 Emissions

Note: Total of Scope 1 and Scope 2 emissions(Net emissions)

| FY2020 | FY2021 | FY2022 | FY2023 | FY2024 | ||||

|---|---|---|---|---|---|---|---|---|

| CO2 emissions |

Scope 1 (t-CO2) | 6,039 | 5,540 | 6,131 | 7,882 | 7,794 | ||

| Scope 2 (t-CO2) | 51,878 | 50,978 | 49,272 | 44,580 | 45,760 | |||

| Scope 1 + Scope 2 (t-CO2) | 57,916 | 56,517 | 55,403 | 52,462 | 53,554 | |||

| Carbon offsetting(t-CO2) | - | - | - | - | 990 | |||

| Net emissions (Scope 1 + Scope 2)(t-CO2) | - | - | - | - | 52,564 | |||

| Scope 3 (t-CO2) | - | - | 1,091,255 | 1,202,209 | 1,325,924 | |||

| Category 1 | Purchased goods and services |

- | - | 576,512 | 636,698 | 677,843 | ||

| Category 2 | Capital goods |

- | - | 95,884 | 110,312 | 159,552 | ||

| Category 3 | Fuel- and energy-related activities not included in Scope 1 and 2 |

- | - | 5,758 | 5,490 | 6,113 | ||

| Category 4 | Upstream transportation and distribution |

- | - | 10,399 | 9,174 | 12,629 | ||

| Category 5 | Waste generated in business operations |

- | - | 2,669 | 2,931 | 4,184 | ||

| Category 6 | Business travel |

- | - | 5,158 | 8,817 | 9,102 | ||

| Category 7 | Employee commuting |

- | - | 710 | 837 | 902 | ||

| Category 8 | Upstream leased assets |

- | - | Not applicable |

Not applicable |

Not applicable |

||

| Category 9 | Downstream transportation and distribution |

- | - | 3 | 2 | 4 | ||

| Category 10 | Processing of sold products |

- | - | Not applicable |

Not applicable |

Not applicable |

||

| Category 11 | Use of sold products |

- | - | 21,792 | 12,284 | 5,979 | ||

| Category 12 | End-of-life treatment of sold products |

- | - | 372,368 | 415,664 | 449,616 | ||

| Category 13 | Downstream leased assets |

- | - | Not applicable |

Not applicable |

Not applicable |

||

| Category 14 | Franchises | - | - | Not applicable |

Not applicable |

Not applicable |

||

| Category 15 | Investments | - | - | Not applicable |

Not applicable |

Not applicable |

||

Notes:

・The amount of renewable energy used (purchased) for fiscal 2021 is included in the total for non-renewable energy.

・For figures excluding Scope 3 emissions, limited assurance or review by a third party has been conducted.

・Past figures may be retroactively revised based on a thorough examination of tabulation results.

・The Scope 3 targets include Bandai, Bandai Spirits, Bandai Namco Entertainment, Bandai Namco Filmworks, and Bandai Namco Amusement.

【Calculation method for Scope 3 CO2 emissions】

Category 1:Amount procured multiplied by the emission factor (excluding internal transactions)

Category 2:Amount of capital investments multiplied by the emission factor (Groupwide)

Category 3:Amount of each type of energy consumed multiplied by the emission factor

Category 4:Amount of transportation services purchased multiplied by the emission factor

Category 5:Amount of each type of waste generated multiplied by the emission factor for each processing method

Category 6:Travel expenses paid for each mode of transportation multiplied by the emission factor. For Bandai Namco Entertainment only, number of employees multiplied by the emission factor

Category 7:Travel expenses paid multiplied by the emission factor for the case in which all travel was on passenger railways

Category 9:Calculated using the ton-kilometer method for the transportation weight of game machines. (Bandai Namco Amusement)

Category 11:For products that use batteries, with an assumption that batteries are changed twice, product sales volume, number of batteries used, and amount of electricity consumed based on average battery lifespan are calculated and multiplied by the emission factor (Bandai)

Calculated by multiplying the annual usage time, derived from the sales quantity of game machines, power consumption, average operating hours, and number of operating days of game centers, by the emission factor. (Bandai Namco Amusement)

Category 12:Weight of sold products multiplied by the emission factor. However, for Bandai and Bandai Spirits, the average weight of products accounting for 10% of sales for each division is used; for Bandai Namco Filmworks, the average weight of the top 10 products by sales volume is used; and for Bandai Namco Amusement, only game machines are considered.

Note: Categories 8, 10, 13, 14, and 15 are not applicable.